Russia, Ukraine, and Your Portfolio’s Path Forward

With Russia’s invasion of Ukraine, on top of inflation concerns in the US and elsewhere, markets have recently been subject to greater volatility as well as declines in value. “Markets,” a term used to describe all global investors, price assets based on available information and the implications they derive from it. It’s reasonable, then, for stock prices to be lower with the introduction of the economic disruption resulting from Russia’s invasion and the global policy response. What investors prefer is clarity of the future. This current environment reduces this clarity, and the result is, and will likely continue to be, sharp price swings as investors attempt to understand what is unfolding and evolving before them in real time. This is reasonable, also. This is essentially what we call “risk.” In the words of Nobel Economics laureate Eugene Fama, “there is always risk in the stock market, always. It never goes away.” This current marketplace, at least in an emotionally detached sense, is reasonable, as well. In a sense, our collective reaction is to check the box: we have fear, as well as financial ambitions; this just means we are alive and rational.

For context, you can look up your current investment exposure to Russia. It is likely very small. Looking into your International or Emerging Markets fund’s prospectus will give you country-by-country allocations.

Our friends at Vanguard have added the following research and perspective:

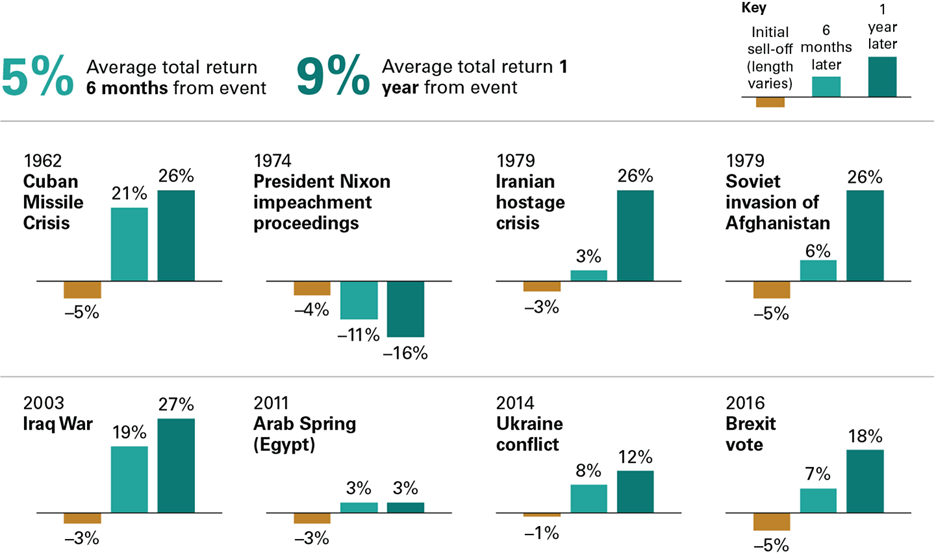

“With geopolitical tensions such as what we’re seeing in Russia and Ukraine, investors often ask whether a link exists between current events and financial markets’ performance. However, when we examine previous geopolitical events from the past 60 years, we find that while equity markets may react negatively to the initial news, geopolitical sell-offs are typically short-lived and returns over the following 12-month period are largely in line with long-term average returns.

Geopolitical sell-offs are typically short-lived

Notes: Returns are based on the Dow Jones Industrial Average through 1963 and the Standard & Poor’s 500 Index thereafter. All returns are price returns. Not shown in the above charts, but included in the averages, are returns after the following events: the Suez Crisis (1956), construction of the Berlin Wall (1961), assassination of President Kennedy (1963), authorization of military operations in Vietnam (1964), Israeli-Arab Six-Day War (1967), Israeli-Arab War/oil embargo (1973), the shah of Iran’s exile (1979), U.S. invasion of Grenada (1983), U.S. bombing of Libya (1986), First Gulf War (1991), President Clinton’s impeachment proceedings (1998), Kosovo bombings (1999), multi-force intervention in Libya (2011), and U.S. anti-ISIS intervention in Syria (2014).

Sources: Vanguard calculations as of December 31, 2021, using data from Refinitiv.

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

“As the illustration shows, it hasn’t taken long for equity markets to recover from initial sell-offs in response to geopolitical events. Yet we wouldn’t have predicted such quick recoveries near the onset of any of these historical sell-offs. Nor do we predict one now as markets digest fast-moving developments related to Ukraine.”

What does this mean for your money? Quite plausibly it will include unsettling movements up and down, as is always possible. It will likely require some fortitude on your part, as well as your wisdom and your good perspective. It is for moments like these, especially, that you should ensure your portfolio is designed for the long term, to include broadly diversified investments managed by steady hands. In a properly constructed portfolio, as you see stocks fall, you may see bonds rise. You will likely see types of your stocks and bonds moving at different rates, all designed to balance your overall portfolio in the face of winds from various directions. Times like these remind us that there are no shortcuts to long-term success. Calmness, perspective, and the resulting careful, thoughtful, portfolios are hallmarks of a good investment plan. At Empowerment Financial Guidance, we are by our very nature patient, disciplined, measured investors. We base our portfolios not on the pursuit of isolated, short-term victories, but on the long arc of our clients’ lifespans. Our investments are tailored accordingly – to help each client in funding all that their lives entail, in the intermediate as well as long term.